Climate change impacts every part of our lives – from our health, wellbeing and the safety of our communities, to the stability and security of the financial and economic systems on which we depend. Unless we take strong action this decade to address its drivers by rapidly cutting emissions, Australians face escalating and compounding risks now and for decades to come.

Australia’s Council of Financial Regulators has officially recognised climate change posing a financial risk since 2017. The Council is made up of our three key regulatory agencies – the Reserve Bank of Australia, the Australian Prudential Regulation Authority and the Australian Securities and Investment Commission, alongside the Federal Treasury. Together, these regulators have acknowledged that the risks climate change poses to the Australian economy are “first order” and have knock- on implications for the functioning of our economic system as a whole (RBA 2021)

Because climate change exacerbates and creates new financial risks, there is strong potential for these to build up within the financial system and tip into systemic risk which would have potentially devastating consequences for us all. We need coordinated action across the whole financial system to reduce its exposure to these risks- from banks, superannuation funds, insurers, investors, governments and regulators. We only need to recall the Global Financial Crisis to appreciate how disruptions to our financial system cause massive social and economic harm. This is why governments and financial regulators work very hard to avoid them.

Yet despite our ability to see climate risks brewing on the near horizon, actions by some financial institutions are still making the problem worse, not better. In the face of clear scientific consensus on the urgent need to phase out the use of coal, oil and fossil gas as quickly as possible, our banks are in fact enabling the opposite: lending billions of dollars to expand the fossil fuel industry. Australian banks have lent tens of billions to expand coal, oil and gas supply since the Paris Agreement was signed in 2015.

Bank lending to fossil fuel expansion drives climate change and, therefore, exacerbates climate risks. While the banking sector and debt financing are the focus of this report, others are also complicit – for example through equity financing via the share market, and superannuation funds. If our leaders have the courage to make bold steps in financial systems regulation, Australia has a golden opportunity to safeguard the health, sustainability and stability of our society before it is too late.

This report outlines current financial system risk arising from fossil fuel investment, focusing on bank lending to fossil fuel expansion and the potential to reform prudential regulation to ensure bank lending is aligned with a decarbonised future. The report also explores the loopholes our banks are exploiting that undermine their strong sustainability commitments. The report outlines global best practices and the positive potential effects of mechanisms such as the Task Force on Climate-Related Financial Disclosures / International Sustainability Standards Board mandate (effective from 2024), forthcoming Sovereign Green Bond program, and Australian sustainable finance taxonomy; and makes recommendations to strengthen the financial system and better protect it against climate change risks

Report key findings:

1. Climate change has the potential to become a systemic risk to our financial system, with grave consequences for our economy and society.

- Australia’s biggest financial institutions are highly exposed to escalating climate risks. What’s more, their ongoing investment in expanding polluting sectors like coal, oil and gas are making this problem worse.

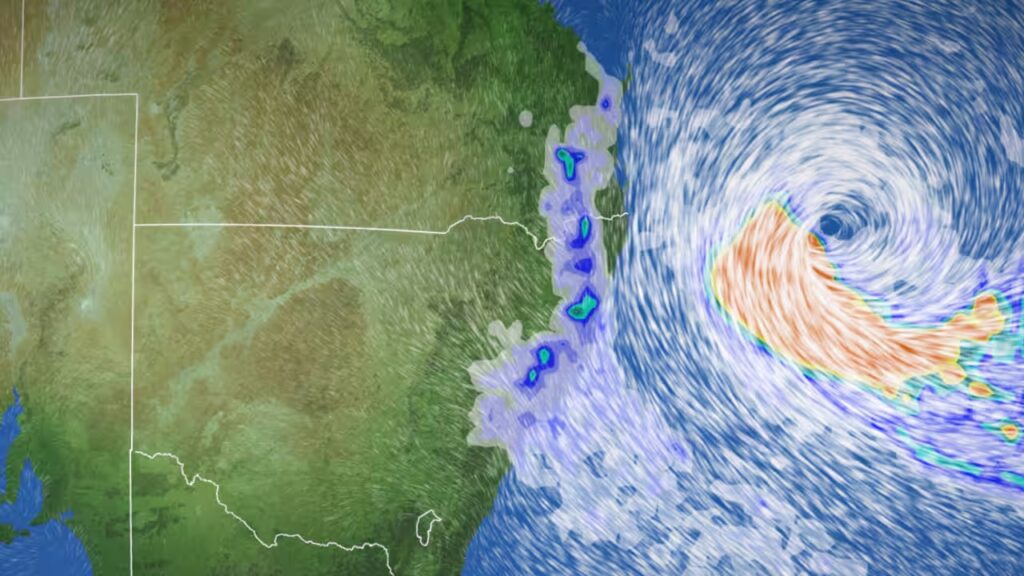

- Extreme weather events like the flooding on the east coast of Australia in 2022 are costing Australian lives, livelihoods and challenging the business model of financial industries like insurance.

- Nearly one in eight homes face home insurance affordability stress. This adds to cost of living pressures already squeezing Australians, and in some cases results in insurance being dropped altogether. For mortgaged properties without insurance, the risk then sits with the bank, adding more climate risk onto bank balance sheets.

- Banking – and the finance sector more broadly – will be heavily affected by risks due to climate change, so they can’t continue with business as usual. Banks should be lending and investing in a way that is consistent with limiting global warming as close as possible to 1.5°C, as a key risk mitigation strategy for their own operations, as well as the financial system.

2. Banks can enable enormous social good, but are bankrolling fossil fuel expansion and driving the climate crisis instead. This is compounding climate risks in the broader financial system.

- Since countries around the world united on an international agreement to address climate change in 2015, through the Paris Agreement, Australia’s “Big Four” banks have lent $57.5 billion to companies and projects that expand fossil fuel supply. This includes $19.2 billion to companies with plans to expand fossil fuel production and $9.5 billion directly for new or expanded projects that undermine efforts to invest in zero emissions alternatives.

- As of December 2022, Australia’s 15 largest superannuation funds had at least $25.1 billion invested in coal, oil, and gas expansion.

- In addition to directly financing coal, oil and gas expansion, banks are also funding fossil

- fuels through a range of investment vehicles. Their corporate finance and bond arrangements enable even more harmful emissions that worsen climate change – a far cry from their sustainability marketing claims.

- The Big Four banks have pledged to invest hundreds of billions of dollars into climate solutions and green assets. However, these efforts are being undermined by the billions of dollars that banks and other financial service companies, such as superannuation and investment banks, keep pouring into the expansion of fossil fuels.

3. Improving the visibility of climate risk is welcome, but isn’t enough on its own to drive capital out of fossil fuels and into clean energy at the speed and scale needed now to tackle the climate crisis.

- Customers and investors require transparency in order to make informed decisions but better visibility of risks isn’t enough on its own – action is required to reduce these risks. For example, banks need a fit-for-purpose strategy and plan to transition their company and clients away from fossil fuels, towards renewable energy.

- Shifting capital towards sustainable investments that enable Australia’s transition to a decarbonised economy is also critical. In the first half of 2023 around $13 billion worth of green bonds were issued.

- The Australian Sustainable Finance Institute’s Taxonomy, the Treasury’s Sovereign Green Bonds Program and Sustainable Finance Strategy are positive developments underway to support allocation of capital to the transition.

- New mandatory climate-related disclosures will provide consistent and clear detail of banks’ exposure to climate risks, emissions, future scenarios and transition plans; highlighting where fossil fuel lending is intensifying climate risks. But steps to hold banks accountable for their decisions are still missing.

4. A coordinated effort involving banks, the Australian Government and financial regulators is needed to protect our financial sector, and enable every part of our economy to rapidly phase out the use of coal, oil and gas.

- Australian banks benefit from strong government regulation, which guarantees the funds of deposit- holders and allows the banks to market themselves as having an increased level of security. From this privileged position they choose to keep investing in the expansion of fossil fuels, contributing to harmful climate change and threatening this protective regulatory framework.

- Every investment in fossil fuel expansion is a diversion and delay from the necessary transition of our entire economy, and undermines Australia’s decarbonisation. Instead, all financial institutions – including the Big Four banks – need to be encouraging and enabling zero- emission solutions at speed and scale.

- New fossil fuel projects are incompatible with limiting global warming and must not be approved. Careful planning by governments, regulators, and financial institutions is also required to transition out of remaining coal, oil and gas in an orderly manner.

- Without this, the Australian public will not only continue to face escalating climate impacts, but also foot the bill of a dying industry. The cost of decommissioning Australia’s offshore oil platforms alone could reach $60 billion over the next 30 years.

- This moment calls for decisive action to strategically realign our entire economy. Requiring more disclosure and then crossing our fingers for a rational market response does not cut it. We need to take the opportunity created by these new climate financial risk management tools to take the next essential step: holding banks more directly accountable for their lending to projects and companies that drive harmful climate change.