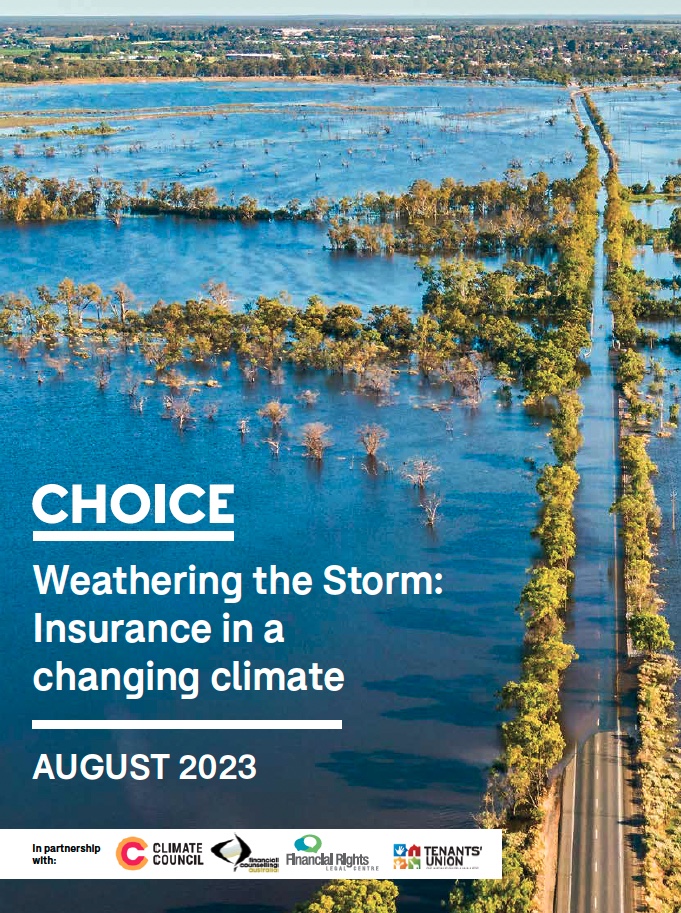

Extreme weather events are worsening across Australia. Since the Black Summer bushfires in 2019-20, there have been 11 declared insurance catastrophes. Since January 2020 insurers have received almost 788,000 claims related to floods and storms that have been declared catastrophes or significant events. As the climate warms, the risk of extreme weather events will continue to increase, likely bringing disasters at a scale and severity for which we are not currently prepared.

Home and contents insurance is essential in helping people and communities recover and rebuild after these types of events. Insurance ideally provides temporary accommodation for people whose homes have been damaged or destroyed, allows them to replace valued possessions and helps them to rebuild their homes and lives.

Unfortunately, however, these benefits of insurance are increasingly out of reach of many people. Climate change is causing premiums to rise, forcing many people to reduce their cover or opt out of insurance altogether. Even where people can afford insurance, inconsistent and confusing policy terms often mean that when they go to make a claim, they find they aren’t covered. And rising costs of rebuilding mean that many people find they haven’t been adequately insured.

The impacts of being uninsured or underinsured aren’t just financial — they also have human impacts. Our research finds that many people who have been through extreme weather events are experiencing significant and ongoing emotional harm, with many reporting ongoing trauma and anxiety, relationship breakdowns, exhaustion and suicidal ideation.

This report, commissioned by CHOICE, Climate Council, Financial Rights Legal Centre, Financial Counselling Australia and the Tenants Union of NSW explores the role of the insurance market in responding to these complex issues. It is informed by a nationwide survey of people that have home insurance, as well as interviews with homeowners and people who rent in communities affected by extreme weather events.

Our research identifies five key consumer problems that are limiting the affordability and accessibility of home and contents insurance.

Consumer problems with home and contents insurance:

1. Complex product design: Home and contents insurance policies are complex and vary across insurers, with inconsistent and incomparable definitions for standard terms, deviations from standard cover and opaque pricing. This can contribute to accidental underinsurance for policyholders. Policies need to be simpler and fairer for people facing the threat of extreme weather.

2. Unaffordable premiums: Insurance premiums are becoming increasingly unaffordable for people living in disaster-prone areas. Many households on low incomes are being priced out of the insurance market entirely. This contributes to a disaster-induced poverty cycle.

3. Inaccessible information on natural hazard risk: People are unable to find out what level of extreme weather risk their homes face now and in the future. Inconsistent and unavailable information is preventing people from making empowered decisions about how to protect themselves and their home.

4. Mitigation measures are not being considered: Many people are not being offered lower premiums if they take mitigation measures which make their home more resilient. Insurers should provide information in a clear and accessible way on measures people can take to lower their risk.

5. Dangerously exposed housing needs solutions beyond insurance: Regions of Australia are becoming increasingly uninsurable and unsafe to live. Communities and homes on the front line of disaster are likely to require solutions beyond insurance, including relocation.

These problems aren’t going away. They’ll get worse before they can get better. And fixing them will require serious and sustained attention by governments and the insurance industry, to ensure that insurance can continue to play a role in assisting people to recover and rebuild after extreme weather events.